Blog

We keep you up to date on the latest tax changes and news in the industry.

Benefits and Risks of Using Personal Financial Apps

Title: Benefits and Risks of Using Personal Financial Apps

Are you looking for new ways to take control of your finances and achieve financial success? Personal financial apps might be the answer you're looking for. In this blog post, we will explore the benefits and risks of using personal financial apps and discuss some of the best apps available on the market.

The Benefits of Personal Financial Apps

Personal financial apps have become indispensable tools for individuals seeking to manage their finances effectively. These apps offer a wide array of features, including budgeting, expense tracking, investment management, and financial education. Here are some of the top personal financial apps and their functions:

1. Mint: Mint is a popular and well-established personal financial app that allows users to set budgets, track spending, and monitor their overall financial health. With its intuitive interface and powerful features, Mint helps individuals gain a clear understanding of their financial picture.

2. Personal Capital: Personal Capital is an app designed for wealth management and investment tracking. It enables users to sync their investment accounts, track their portfolio performance, and receive personalized investment advice. With Personal Capital, you can stay on top of your investments effortlessly.

3. PocketGuard: If budgeting is your priority, PocketGuard is an excellent choice. This app connects to your bank accounts, credit cards, and loans to provide you with a real-time view of your spending. It automatically categorizes your expenses and helps you set and track your budget goals.

4. YNAB (You Need A Budget): As the name suggests, YNAB focuses on helping users budget effectively. It follows a zero-based budgeting approach, where every dollar is allocated to a specific category. With its emphasis on planning and goal setting, YNAB is a powerful tool to achieve financial discipline.

The Cost of Personal Financial Apps

The good news is that many personal financial apps offer free versions with basic features. It's always a good idea to test them out and see which one suits your needs. However, if you're looking for advanced functionalities and personalized support, some apps have premium paid versions. These paid versions typically come with additional features like investment tracking, priority customer support, and more robust automation options. The cost of these premium versions can range from $5 to $30 per month. Assess your needs and budget before deciding which version is right for you.

The Risks and Challenges of Using Personal Financial Apps

While personal financial apps offer convenience and powerful tools, it's important to be aware of the potential risks and challenges associated with using them. Here are some of the main risks to consider:

1. Security and Privacy Concerns: It's crucial to consider the security measures in place when choosing a personal financial app. Make sure the app has robust encryption and safeguards to protect your sensitive financial information. Also, be mindful of the permissions you grant and stay alert for any suspicious activity.

2. Over-reliance on Automation: Personal financial apps make it incredibly easy to automate your financial management. However, it's important not to become too complacent and blindly follow the app's recommendations. Exercise critical thinking and review the automated actions to ensure they align with your financial goals.

3. Drowning in Data: Personal financial apps provide a wealth of data and insights, but it can sometimes feel overwhelming. Stay focused on the key metrics that matter to you and avoid getting bogged down by excessive data analysis that may not be relevant to your specific goals.

4. Interference with Personal Finance Skills: While convenient, personal financial apps can inadvertently hinder the development of your personal financial skills. Striking a balance between leveraging technology and engaging in learning and decision-making processes is important. Remember, financial literacy is essential for long-term success.

5. App Reliability and Continuity: Personal financial apps depend on technology infrastructure and app availability. While rare, there may be instances when apps experience technical issues or even cease operations. Having backup systems and alternate resources is advisable to ensure you can continue managing your finances even if the app is temporarily unavailable.

Conclusion

Personal financial apps offer a range of benefits, from budgeting to investment tracking, and can be transformative tools for managing your money. However, it's important to consider the costs involved and be mindful of the potential risks. Choose an app that aligns with your needs, analyze the security measures, and avoid over-reliance on automation. Stay focused on the key metrics that matter to you and continue developing your personal financial skills. With the right app and a balanced approach, personal financial apps can propel your financial journey and help you achieve your goals.

Thank you for reading the Ask Ralph blog. We value your feedback, reviews, and questions. Visit our podcast page at askralphpodcast.com to engage with us further. Your engagement fuels this podcast, and we appreciate your input. Stay financially savvy, keep exploring, and embrace the power of personal financial apps.

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

TAX ASSURANCE PRICING

Personal Income Tax Services

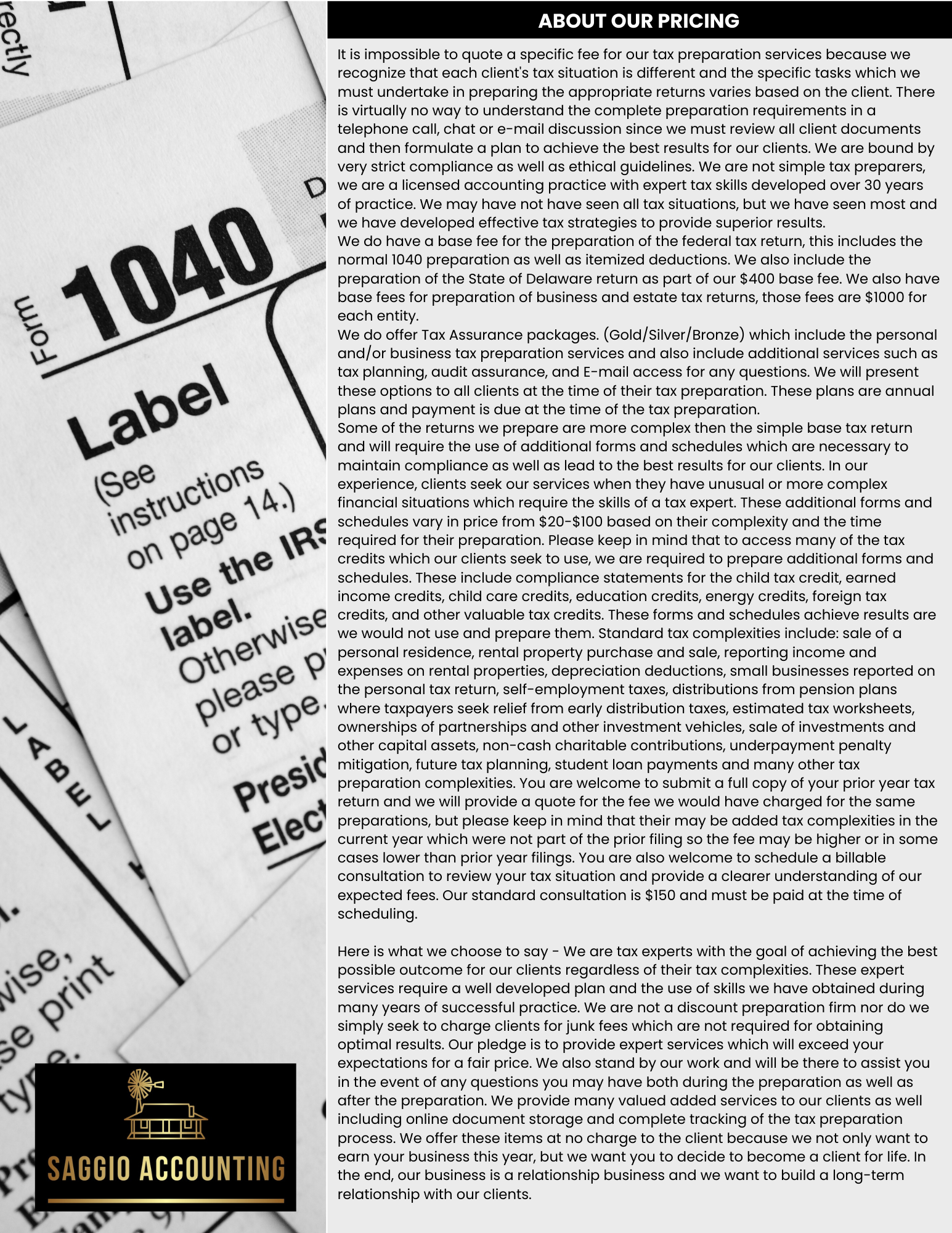

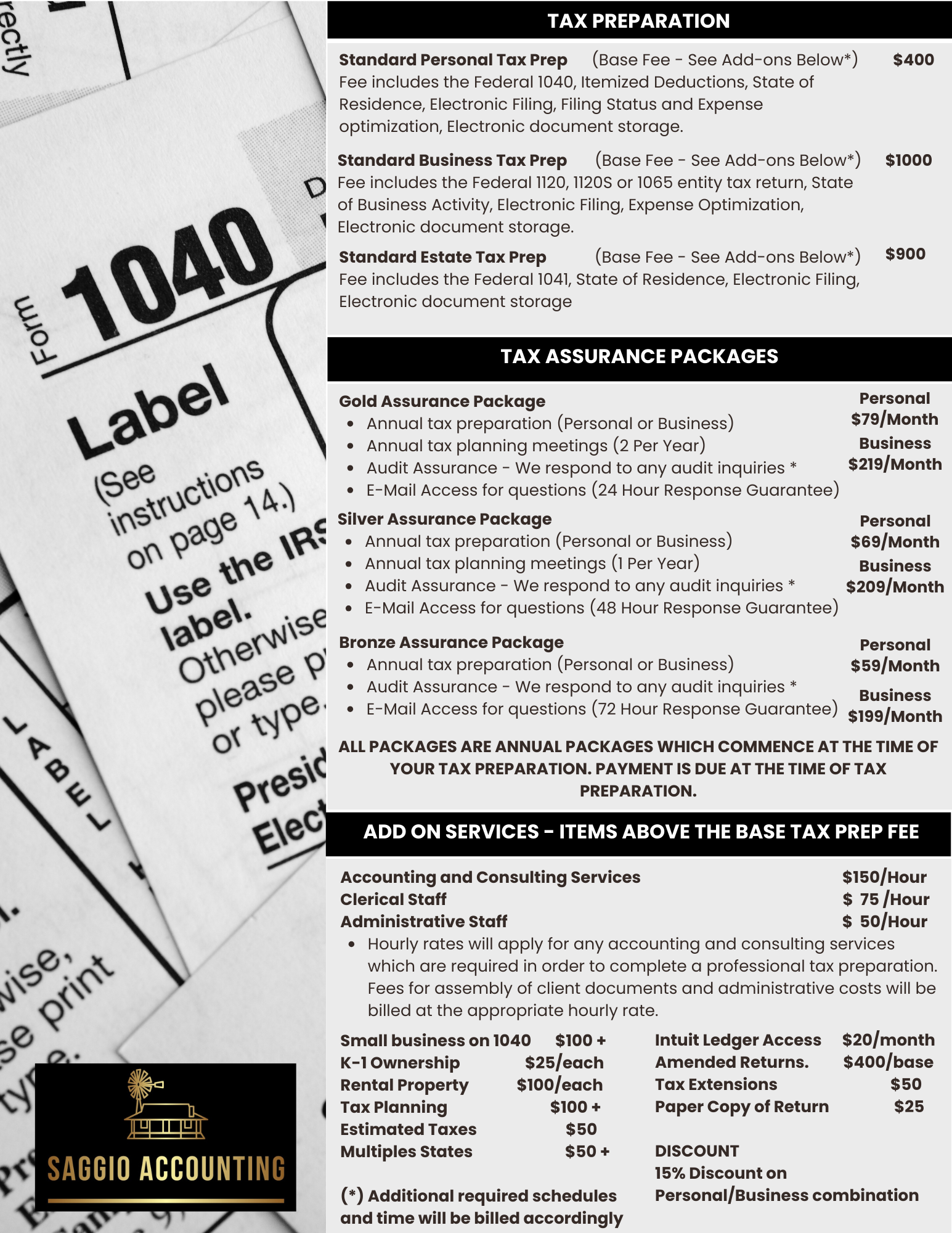

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)