Blog

We keep you up to date on the latest tax changes and news in the industry.

Choosing Your Accounting Method Under New Tax Laws

Businesses today must take a closer look at their accounting methods. Since the passage of new tax laws, with changes to thresholds for choosing accounting methods, all companies need to take an inward look at their current accounting methods to determine if they are the most beneficial permissible method applicable. It is important to work closely with accounting professionals here — making changes as well as decisions on how accounting methods need to be updated.

What Is Changing?

The Tax Cuts and Jobs Act put into place new laws for a variety of sectors. One key area impacted that many business owners do not immediately consider is accounting. The overall method of accounting and the type of business can be key factors to consider. This tax reform set out to support small business owners and offer key ways to reduce some taxes. It also put into place provisions and accounting method reform with a focus on keeping things simple. Outdated methods of accounting minimized the amount of information shared, but they tend to overcomplicate methods. This is especially true with outdated gross receipt thresholds. Old methods required business owners to use accrual basis accounting which tends to increase overall administrative costs and compliance requirements.

Here is a look at some of the key changes businesses should recognize moving forward.

Limits on Cash Method of Accounting Improved

One key change is the limitation on which businesses can use the cash method of accounting. Previously, companies could not use the cash method of accounting — commonly considered the most natural and more affordable method — as an option if they reached a threshold in revenue. Previously, this method could not be used if the average annual gross receipts for the company were limited to companies with revenue under $10 million, except for the following companies that are that are limited to $1 Million:

- Retailing (NAICS codes 44 and 45);

- Wholesaling (NAICS code 42);

- Manufacturing (NAICS codes 31 – 33);

- Mining (NAICS codes 211, 212);

- Publishing (NAICS code 5111); or

- Sound recording (NAICS code 5112).

Changes in Inventory Accounting

The law also changes Internal Revenue Code Section 263A. These UNICAP rules made for very specific restrictions for business owners. Prior to the changes, the revenue threshold was subject to the UNICAP rules. It requires businesses that maintain an inventory to apply specific costs to their inventory. When this cost is applied, it raises the company’s balance sheet. Overall, it increases the amount of taxable income the company has, therefore making it harder to overcome the threshold.

Now, companies with $25 million in revenue that qualify for the cash method of accounting will be able to note their inventories as non-incidental supplies or materials. Another option is to use their financial accounting treatment for inventories.

Long-Term Contract Changes

Another key area of the law has to do with long-term contracts. Previously, any business with $10 million or less in average annual gross receipts and maintained contracts expected to end within two years were considered small contractors. As a result of this classification, the businesses did not have to use a percentage of completion method of accounting. This helped streamline efforts for the company. The new law still applies for the most part. However, the new law increases that threshold from $10 million up to $25 million. And, it is indexed for inflation. This means more companies — those with revenue under $25 million — now achieve this same benefit.

What Does This Change Mean for You?

As a business owner, it can mean significant changes. When you meet with your accounting professionals, it will be important to look at several things:

- Do the changes apply to your situation? Any business around the gap of $10 million ($1 Million for certain companies) to $25 million may need to consider the new methods of accounting available to them.

- Do the changes benefit the company? Choosing the cash method of accounting over the accrual method is often beneficial, but not to all organizations.

- Does the change require substantial changes to business operations? Though operations may stay the same, tax planning will change.

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

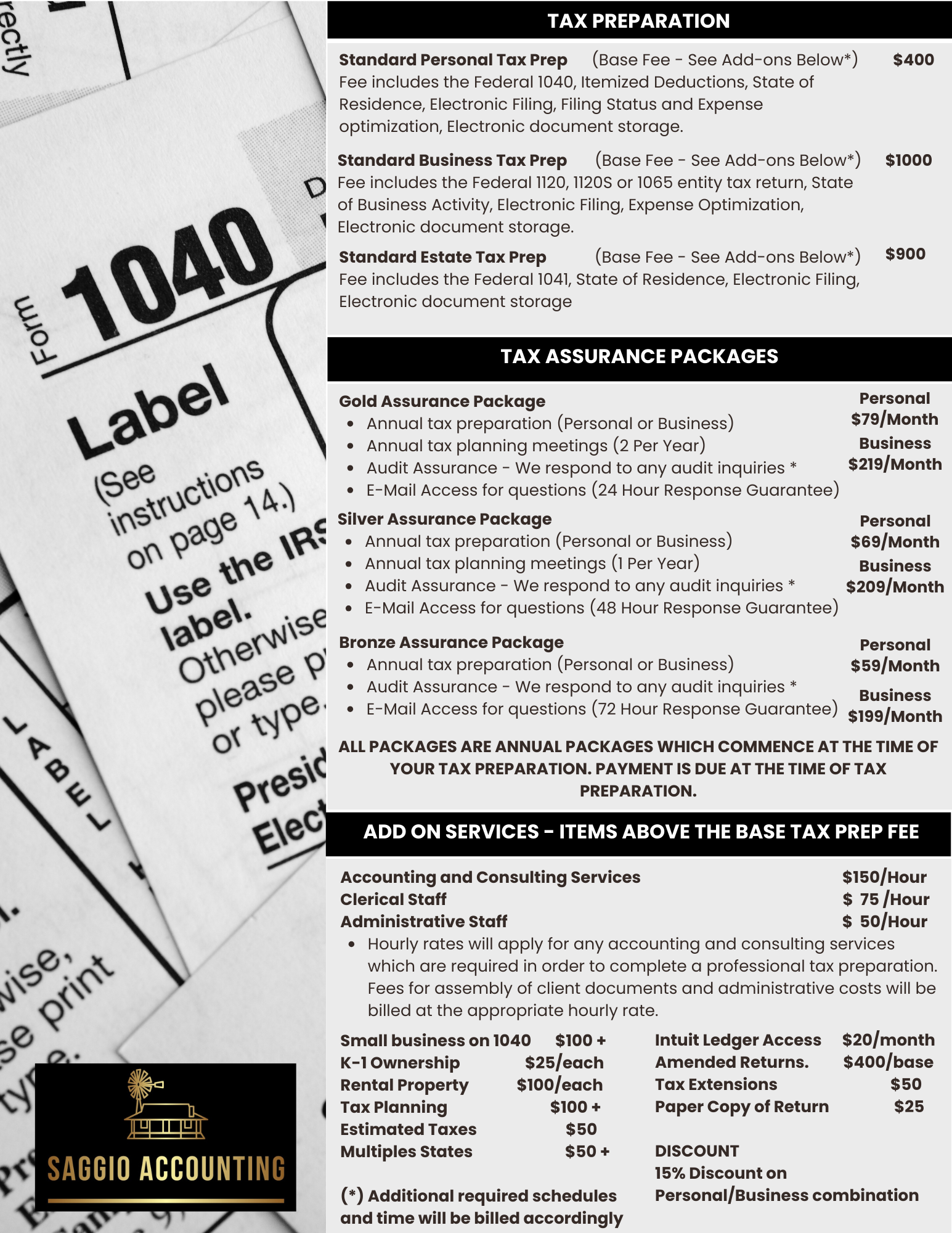

TAX ASSURANCE PRICING

Personal Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)