Blog

We keep you up to date on the latest tax changes and news in the industry.

Converting Personal Vehicles to Business Use

Title: Converting Personal Vehicles to Business Use: A Strategic Financial Move

Introduction:

Welcome to another enlightening episode of the Ask Ralph Podcast! In this episode, we will explore the world of converting personal vehicles to business use. This strategic move can have a significant impact on your financial success. Are you looking to master your finances, lower your taxes, grow your business, and find personal success? Well then, this episode is precisely what you need, so let's get started!

Convert Your Personal Vehicle to Business Use:

Converting your personal vehicle to business use is a valuable financial move that can provide numerous benefits. The primary advantage is the ability to deduct the expenses associated with your vehicle's business use. By converting your vehicle, expenses such as mileage, fuel, maintenance, repairs, insurance, and even the interest on a loan used to purchase or lease the vehicle become deductible. This reduction in taxable income can potentially keep more money in your pocket. Converting your personal vehicle to business use is like getting paid to drive – it's a win-win situation.

Initial Considerations:

Before proceeding with the conversion process, there are a few important considerations to keep in mind. First and foremost, consult with a tax professional or accountant to determine the best approach for your specific situation. They will guide you through the necessary steps and ensure you maximize your tax savings while remaining compliant with the law. Once you have consulted with a tax professional, you can determine the percentage of business use for your personal vehicle. This will help you calculate the amount you can deduct as a business expense. Remember, accurate documentation is key, so keep a detailed log of your business-related mileage and the purpose of each trip.

Tracking Expenses:

To successfully convert your personal vehicle to business use, it is essential to document and track all expenses related to your vehicle's business use. These expenses can include fuel costs, maintenance and repairs, insurance premiums, and even the interest on loans used to purchase or lease the vehicle. Saving your receipts and invoices is crucial for proper documentation. Consider creating a designated folder or using a digital expense tracking tool to keep everything organized. Having proper documentation simplifies your tax filings and serves as valuable evidence in case of an audit.

Choosing the Right Deduction Method:

When it comes to deducting expenses associated with your vehicle's business use, there are two options: the standard mileage rate or actual expenses. The standard mileage rate is set by the IRS each year and allows you to deduct a certain amount per mile driven for business purposes. On the other hand, deducting actual expenses requires tracking and documenting every expense. Carefully evaluate your situation and consult with a tax professional to determine the most beneficial deduction method for your specific circumstances. Remember, you cannot use both methods simultaneously.

Insurance Requirements:

One crucial aspect often overlooked when converting your personal vehicle to business use is insurance requirements. It is critical to inform your insurance provider of the changes to ensure you have appropriate coverage. Operating a vehicle for business purposes can present different risks, and you want to make sure you are adequately protected. Failure to inform your insurer may result in denied claims or non-renewal of your policy. Contact your insurance provider, explain your intentions, and discuss any necessary adjustments to your policy.

Conclusion:

Converting your personal vehicle to business use is a strategic financial move that can transform the way you approach taxation. It allows you to maximize deductions and fuel the growth of your business. Remember, always consult with a tax professional or accountant to ensure you are making the best decisions for your specific circumstances. Keep meticulous records, choose the most advantageous deduction method, and update your insurance coverage accordingly. For more insightful episodes and information, visit our podcast page at askralphpodcast.com.

Remember, as Ralph always says, stay financially savvy!

Please share our Podcast with all your friends and family!

Submit your questions or ideas for future shows - email us at ralph@askralph.com or leave a voicemail message on our podcast page Leave A Voicemail Message

Like us on Facebook and follow us on Facebook at https://www.facebook.com/askralphmedia Twitter (@askralphmedia) or visit www.askralphpodcast.com for more information.

To schedule a consultation with Ralph's team, contact him at 302-659-6560 or go to www.askralph.com for more information!

Buy Ralph's Book - Mastering Your Finances! on Amazon

Buy Ralph's Book - Gospel of Entrepreneurship: Following Jesus in Your Business Journey

on Amazon

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

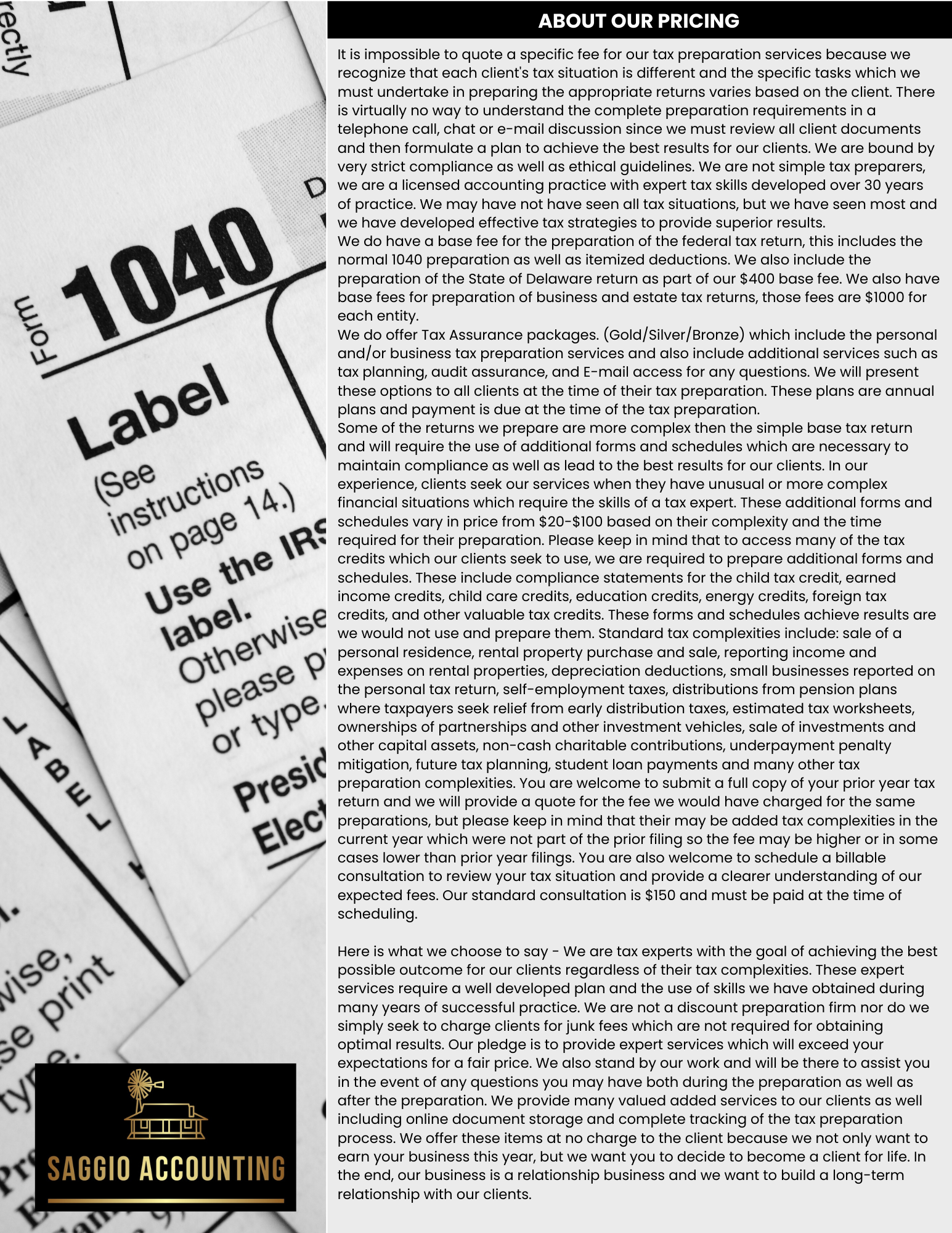

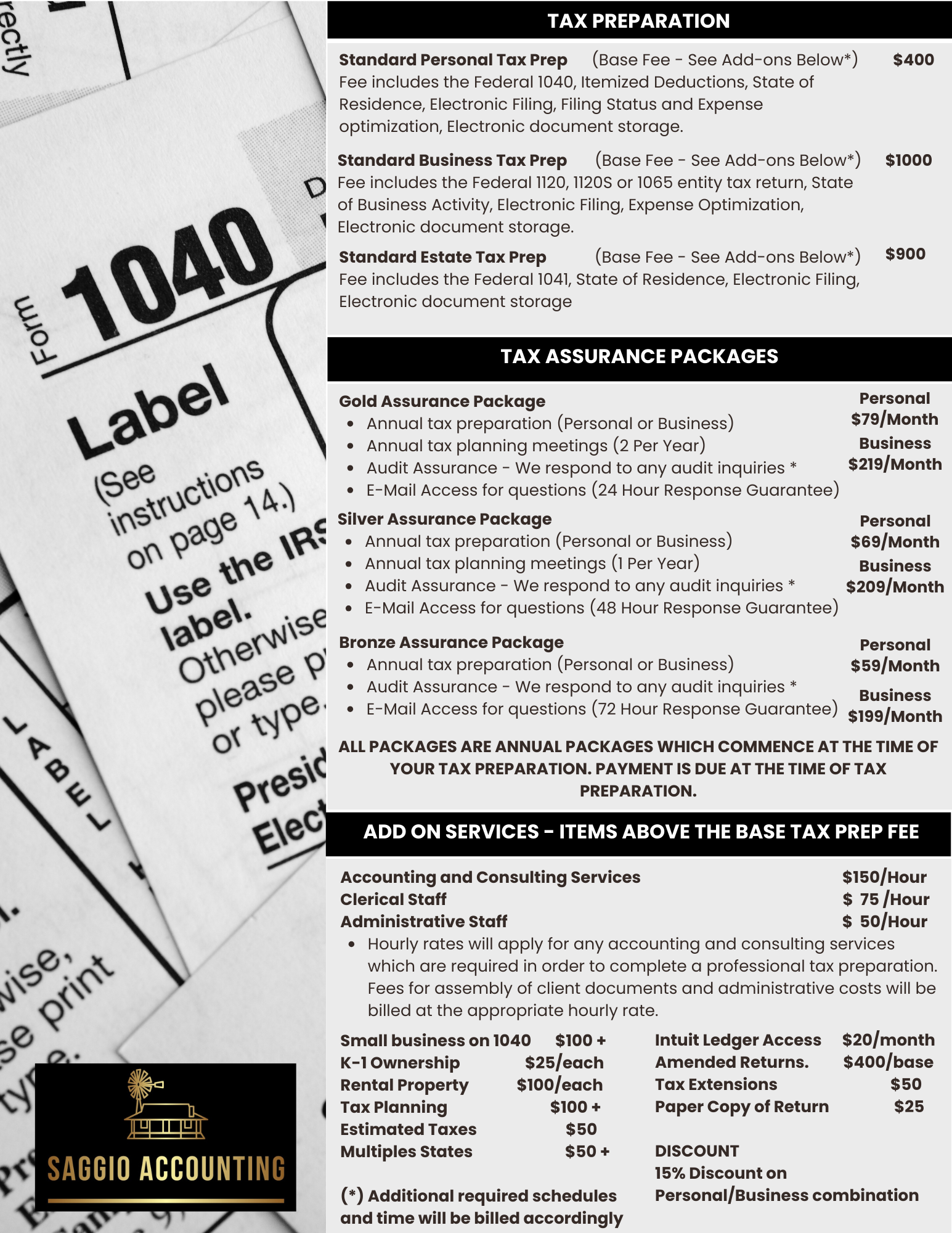

TAX ASSURANCE PRICING

Personal Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)