Blog

We keep you up to date on the latest tax changes and news in the industry.

How Biden's Proposed American Families Plan Might Affect You

Article Highlights:

- Education Benefits

- Education, Teachers and Educators

- Child Tax Credit

- Child & Dependent Care Tax Credit

- Earned Income Tax Credit for Childless Workers

- Paid Family Leave

- Health Insurance

- Corporate Tax Rate

- Individual Marginal Tax Rates

- Capital Gains Tax

- Basis Step-up

- Carried Interest

- Like-kind Exchange for Real Estate

- Excess Business Losses

- Medicare Tax

- Tax Preparer Regulation

- Compliance

- Bank Information Reporting

BENEFITS

Education Benefits – The AFP primarily incorporates education benefits that, if passed, would add four years of free public education and provide federal funds to certain higher education institutions. More specifically, it would address:

- Pre-Kindergarten Education – Provide free universal preschool to all three- and four- year-olds.

- Community College Education – Provide two years of tuition-free community college education, including for DREAMers.

- Pell Grants – Increase Pell Grants by approximately $1,400 to assist low-income families and DREAMers.

- College Retention and Completion Rates – Include a $62 billion grant program to invest in completion and retention activities at colleges and universities (particularly community colleges) that serve high numbers of low-income students. States, territories and tribes will receive grants to provide funding to colleges that adopt innovative, proven solutions for student success.

- Subsidized Tuition – For families earning less than $125,000, provide two years of subsidized tuition at historically black colleges and universities and other minority-serving institutions. The plan would expand and create additional grants for these schools to strengthen their academic, administrative and fiscal capabilities, including by creating or expanding educational programs in high-demand fields such as STEM, computer sciences, nursing and related health care.

Child Tax Credit – The President is proposing that the Child Tax Credit increases included in the American Rescue Plan Act (ARPA) be made permanent. The ARPA increased the Child Tax Credit from $2,000 per child to $3,000 per child six years old and above and $3,600 per child under six years old. It also made 17-year-olds eligible children for the credit and made the credit fully refundable and payable periodically during the year. These changes were for 2021 only. The AFP proposal would extend the ARPA increases through 2025 and make the refundability permanent.

Child & Dependent Care Tax Credit – The ARPA, for 2021 only, made this credit fully refundable and provided a credit equal to 50% of the expenses before phaseout. The maximum amount of expenses that can be used to compute the credit was increased to $8,000 for one qualified individual and $16,000 for two or more qualified individuals. As under prior law, a dependent child qualifies if they are under the age 13. The maximum credit is $4,000 (50% of $8,000) for one eligible individual and $8,000 (50% of $16,000) for two or more eligible individuals. The AFP would make these changes permanent.

Earned Income Tax Credit (EITC) for Childless Workers – The ARPA essentially tripled the EITC for childless workers for 2021 only. The one-year change increased the maximum credit from $543 to $1,502. Biden is asking Congress to make this increase permanent.

Paid Family Leave – The AFP would create a program that would ensure workers receive partial wage replacement to take time to bond with a new child, care for a seriously ill loved one, deal with a loved one’s military deployment, find safety from sexual assault, stalking or domestic violence, heal from a serious illness of their own or take time to deal with the death of a loved one. It would guarantee twelve weeks of paid parental, family and personal illness/safe leave by year 10 of the program and also ensure that workers get three days of bereavement leave per year starting in year one. The program would provide workers up to $4,000 a month, with a minimum of two-thirds of average weekly wages being replaced, rising to 80 percent of average weekly wages for the lowest-wage workers.

Health Insurance

– The AFP would extend the expanded ACA health insurance premium tax credits included in the ARPA that lowered health insurance costs by an average of $50 per person per month for nine million people, and it would enable four million uninsured people to gain coverage. In addition to other provisions, individuals would be able to enroll in Medicare at age 60.

TAX INCREASES TO PAY FOR THE BENEFITS

Corporate Tax Rate – The proposal would increase the corporate tax rate from 21% to 28% (the rate was 35% before the 2018 tax reform).

Individual Marginal Tax Rates – The proposal would increase the top marginal tax rate from 37% to 39.6% for taxpayers with taxable income in excess of $400,000. That may be an oversimplification since tax rates take into account a taxpayer’s filing status. According to Jen Psaki, the White House press secretary, the 39.6% rate would apply to families with a taxable income of $509,300 or greater and single individuals with a taxable income of $452,700 or greater. Also, keep in mind that tax rates are adjusted for inflation annually.

Capital Gains Tax – The proposal would end the lower maximum capital gains rates for households making over $1 million (the top 0.3 percent of all households), thus having them pay the same 39.6% rate on all their income and equalizing the rate paid on investment returns and wages.

Basis Step-up – Currently, when assets are inherited, their basis in the hands of the beneficiary is the fair market value of the asset at the date of the decedent’s death. Taxable gain when an asset is sold is the difference between the selling price and the asset’s basis. Thus, under current law, assets can be transferred to beneficiaries without any income tax liability for the beneficiaries.

Under the AFP, any basis step-up would be eliminated for gains in excess of $1 million ($2.5 million per couple when combined with existing real estate exemptions), ensuring the gains will be taxed if the property is not donated to charity. The reform would be designed with protections so heirs will not have to pay taxes on family-owned businesses and farms given to them if they continue to run the business.

Carried Interest – Carried interest is a share of a private equity partnership’s or fund’s profits that serves as compensation for fund managers. Because carried interest is considered a return on investment, currently it is taxed at a capital gains rate and not an ordinary income rate. The proposed tax changes would eliminate carried interest, and thus the income would be taxed at ordinary rates.

Like-kind Exchange for Real Estate – Sec 1031 of the Internal Revenue Code allows taxpayers to exchange real estate used in business or for investment for other business or investment real estate and avoid taxation by deferring the gain in the replacement property. The proposed plan would eliminate Section 1031 like-kind exchanges for real estate investors when they exchange property on gains greater than $500,000.

Excess Business Losses - An “excess business loss” is the excess (if any) of the taxpayer’s aggregate deductions for the tax year that are attributable to trades or businesses of the taxpayer (determined without regard to whether or not the deductions are disallowed for that tax year) over the sum of

(ii) $250,000 (200% of that amount for a joint return (i.e., $500,000)). This amount is adjusted for inflation.

The current limitation is through 2021. The proposed changes would permanently extend the current limitation restricting large excess business losses.

Medicare Tax – Currently there is a 2.9% Medicare surtax on earned income (wages, self-employment) for taxpayers whose earnings exceed $250,000 (joint), $125,000 (married filing separate) or $200,000 (others). When added to the regular 0.9% Medicare rate, the total paid is 3.8%. There is also a 3.8% Medicare surtax on net investment income that applies when the taxpayer’s income exceeds $250,000, $125,000 or $200,000, depending on their filing status. Biden’s plan would apply the 3.8% surtax consistently to those with income over $400,000.

Tax Preparer Regulation – The proposal would give the IRS the authority to regulate paid tax preparers. Currently, CPAs and Enrolled Agents have continuing education requirements, as do tax preparers in Oregon and California. However, in other states, individuals can prepare tax returns without any oversight, which results in high error rates. These unregulated preparers charge taxpayers large fees while exposing them to costly audits.

Compliance – The proposal would substantially raise the IRS’s budget to increase tax compliance of high-income earners and large corporations, businesses and estates.

Bank Information Reporting – The proposal would require financial institutions to report to the IRS how much money came into and out of individuals’ and businesses’ accounts each year.

This material is a synopsis of key provisions of the President’s American Families Plan but does not include all proposed changes. Consult the White House fact sheet for additional provisions and details.

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

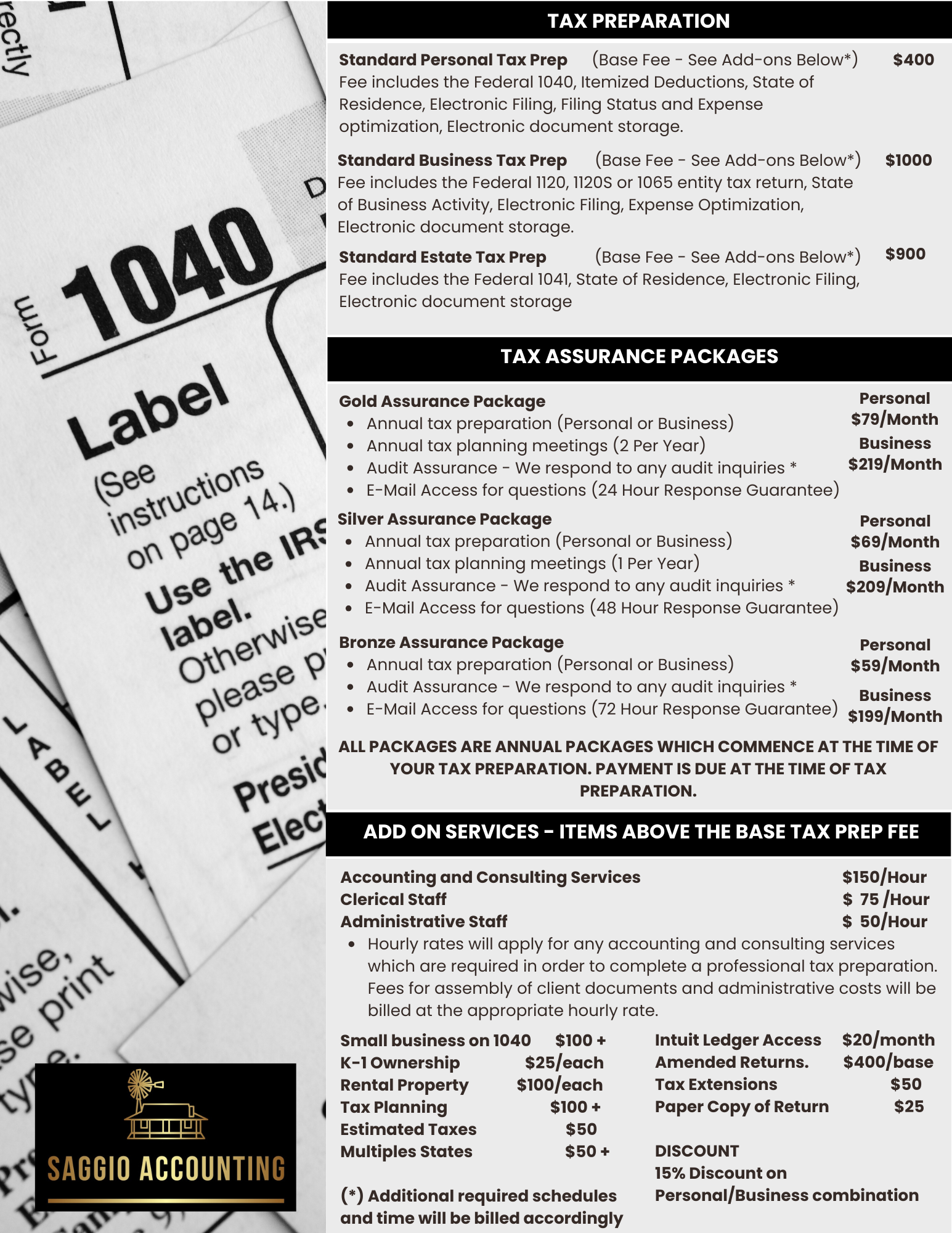

TAX ASSURANCE PRICING

Personal Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)