Blog

We keep you up to date on the latest tax changes and news in the industry.

Tax Deductions for Educators

Professional Fees & Dues:

Dues paid to professional societies related to your educational profession are deductible. These could include professional organizations, business leagues, trade associations, chambers of commerce, boards of trade and civic organizations. However, dues paid for memberships in clubs organized for business, pleasure, recreation or other social purpose are not deductible. These could include country clubs, golf and athletic clubs, airline clubs, hotel clubs and luncheon clubs.

Deductions are allowed for payments made to a union as a condition of initial or continued membership. Such payments include regular dues, but not those that go toward defraying expenses of a personal nature. The portion of union dues that goes into a strike fund is deductible, however.

Continuing Education:

Educational expenses are deductible under either two conditions: (1) your employer requires the education in order for you to keep your job or rate of pay; or (2) the education maintains or improves your skills in the education profession. The cost of courses that are taken to meet the minimum requirements of a job or that qualify you for a new trade or business are not deductible. NOTE: Education undertaken to qualify a classroom teacher as a school administrator or guidance counselor generally meets the criteria foreducational expense deductions.

Communication Expenses:

The basic local telephone service costs of the first telephone line provided in your residence are not deductible. However, toll calls from that line are deductible if the calls are business-related. The costs of a second line (basic service and toll calls) in your home are also deductible if that line is used exclusively for business.

When communication equipment, such as a cell phone, is used part for business and part personally the cost of the equipment must be allocated to deductible business use and non-deductible personal use. Keep your bills for cellular phone use and mark all business calls.

Auto Travel:

Your auto expenses are based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and work each day or between home and one or more regular places of work are COMMUTING expenses and are NOT deductible. Document business miles in a record book by the following: (1) give the date and business purpose of each trip; (2) note the place to which you traveled; (3) record the number of business miles; and (4) record your car’s odometer reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses – gas, oil, repairs, insurance, etc. – and of any reimbursement you received for your expenses.

Out-of-Town Travel:

Expenses incurred when traveling away from “home” overnight on job-related and continuing education trips that were not reimbursed or reimbursable by your employer are deductible. Your “home” is generally considered to be the entire city or general area where your principal place of employment is located. Out-of-town expenses include transportation, meals, lodging, tips and miscellaneous items like laundry, valet, etc.

Document away-from-home expenses by noting the date, destination and business purpose of your trip. Record business miles if you drove to the out-of-town location. In addition, keep a detailed record of your expenses – lodging, public transportation, meals, etc. Always list meals and lodging separately in your records. Receipts must be retained for each lodging expense. However, if any other business expense is less than $75, a receipt is not necessary if you record all of the information timely in a diary. You must keep track of the full amount of meal and entertainment expenses even though only a portion of the amount may be deductible.

If you travel away from home primarily to obtain education (for example, to attend a university extension course overseas) that is related to your job and is an allowed education expense, your expenses for travel, meals and lodging while away from home are deductible. But traveling away from home is not itself a form of education, and therefore is not deductible. For example, if you are a French teacher, taking a tour of France to help improve your command of the French language would not be deductible.

Classroom Supplies:

Generally to be deductible, items must be ordinary and necessary to your profession as an educator and not reimbursable by your employer. Record separately items having a useful life of more than one year. The cost of these items must be recovered differently on your tax return than other recurring, everyday business expenses like photocopies or books.

Miscellaneous Expenses:

Expenses of looking for new employment in the same line of work in which you are already working are deductible – you do not have to actually obtain a new job in order to deduct the expenses. Out-of-town job-seeking expenses are deductible only if the primary purpose of the trip is job seeking, not pursuing personal activities.

CLICK HERE FOR THE FORM

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

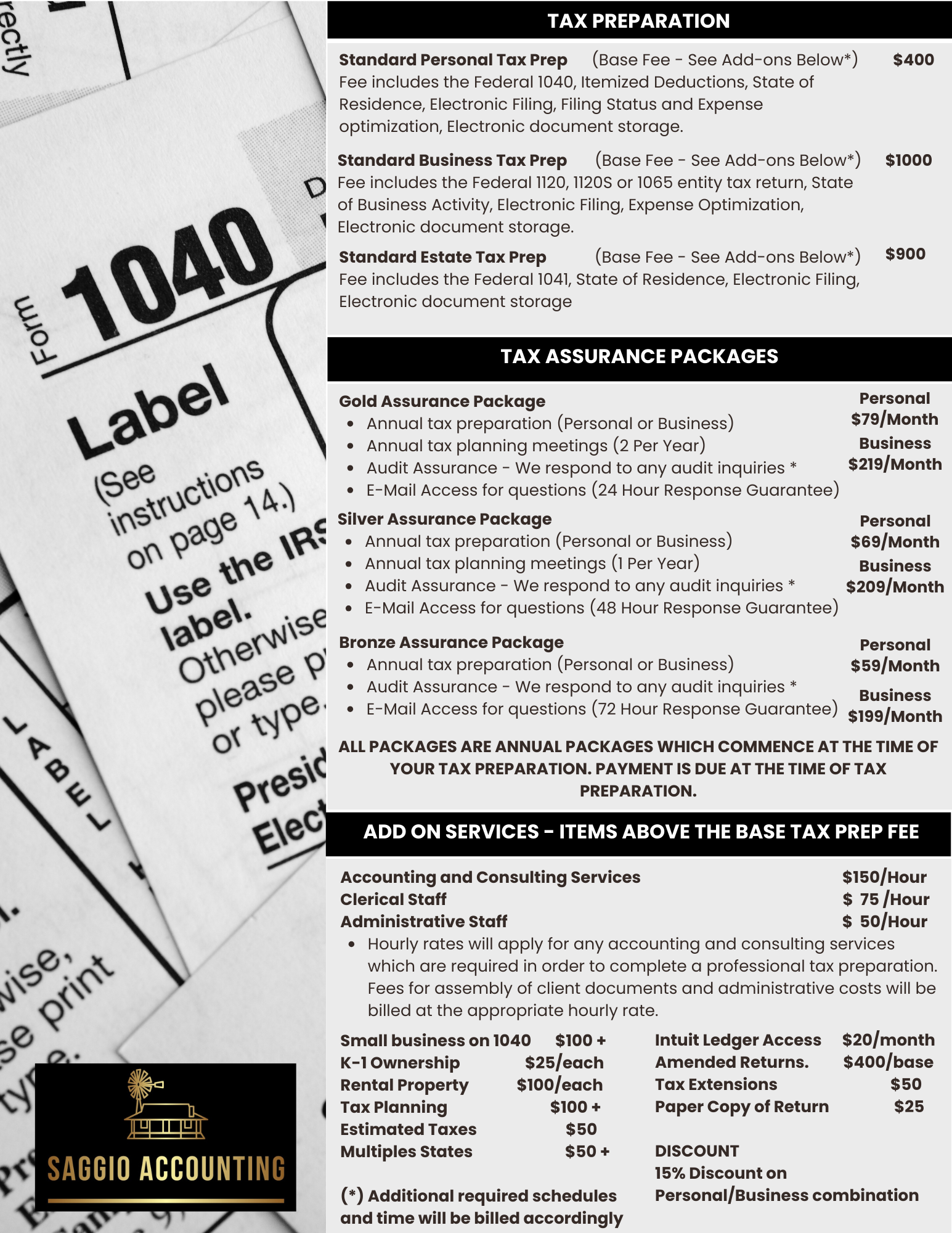

TAX ASSURANCE PRICING

Personal Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)