Blog

We keep you up to date on the latest tax changes and news in the industry.

What is an IRS Penalty Abatement and Am I Eligible for One?

There are different types of IRS penalties that can be assessed against you. The most common penalties include those for failing to file a tax return, filing your return late, or accuracy-related penalties if you didn’t correctly state items on your tax return. But were you aware that sometimes, the IRS can issue penalty abatements if you believe you’ve been penalized unfairly?

Civil penalties for underpayment, late filing, or erroneous inaccuracy may be eligible for abatement, but criminal penalties for tax protest and willful violations of the law are not. There is also the first-time penalty administrative waiver program (FTA) that applies in certain cases. Here’s what you need to know about successfully fighting IRS penalties and determining eligibility for the waiver program.

What a Penalty Abatement Does NOT Include

Regardless of whether you are trying to secure an ordinary penalty abatement or relief under the FTA program, penalty abatement procedures are only for the penalties themselves. They do not include interest on unpaid taxes, the amount of the taxes themselves, or any related processing fees such as installment agreement setup charges.

If your abatement request is successful, only the interest charged on the penalty would be abated, opposed to interest on unpaid taxes.

Proving Hardship for Failure to File or Failure to Pay Penalties

The failure to file penalty kicks in if you file your tax return late, or not at all, and is based on 5% of your unpaid taxes every month (up to 25% of your total balance due). The best way to avoid this penalty is to file for a six-month extension prior to the tax filing deadline if you don’t think you’ll get your return filed on time. The extension won’t waive interest, taxes, or penalties for failure to pay or deposit, but it will eliminate the failure to file penalty, which is much higher.

The IRS will consider penalty abatement requests provided that you have reasonable cause for not being able to file or pay your taxes in a timely manner. Valid hardships, such as hospitalization, natural disasters, or fleeing domestic violence, are factored into reasonable cause to get certain civil penalties waived.

Failure to pay penalties result from having an unpaid balance due, with 0.5% being charged every month. Simply lacking funds to pay your taxes doesn’t necessarily equate to hardship to file your tax return on time or pay your tax bill. However, if you have a continuous lack of funds due to disability or chronic illness, a death in the family, or similar hardships, you may be eligible for relief from the failure to pay penalty.

First-Time Penalty Administrative Waiver (FTA Program)

Under the FTA program, you can have failure to file, failure to pay, and failure to deposit penalties waived if you were never assessed penalties in the past three tax years or had them relieved because of reasonable cause. Estimated tax penalty (deposit penalty), as is common with self-employed taxpayers, is the only allowable penalty to bear.

You must also be current on all of your current tax returns or extensions and paid any taxes due (or arrangements like payment plans). If your charges include failure to pay penalties, it’s a good idea to wait until you’ve paid the entire balance before requesting FTA waivers since you don’t need to prove hardship and can get more waived.

FTA waivers are the best option if you meet the above requirements as this request takes less time to process than ordinary penalty abatement, because you don’t need to establish reasonable cause or hardship.

Sign up for our newsletter.

Each month, we will send you a roundup of our latest blog content covering the tax and accounting tips & insights you need to know.

We care about the protection of your data.

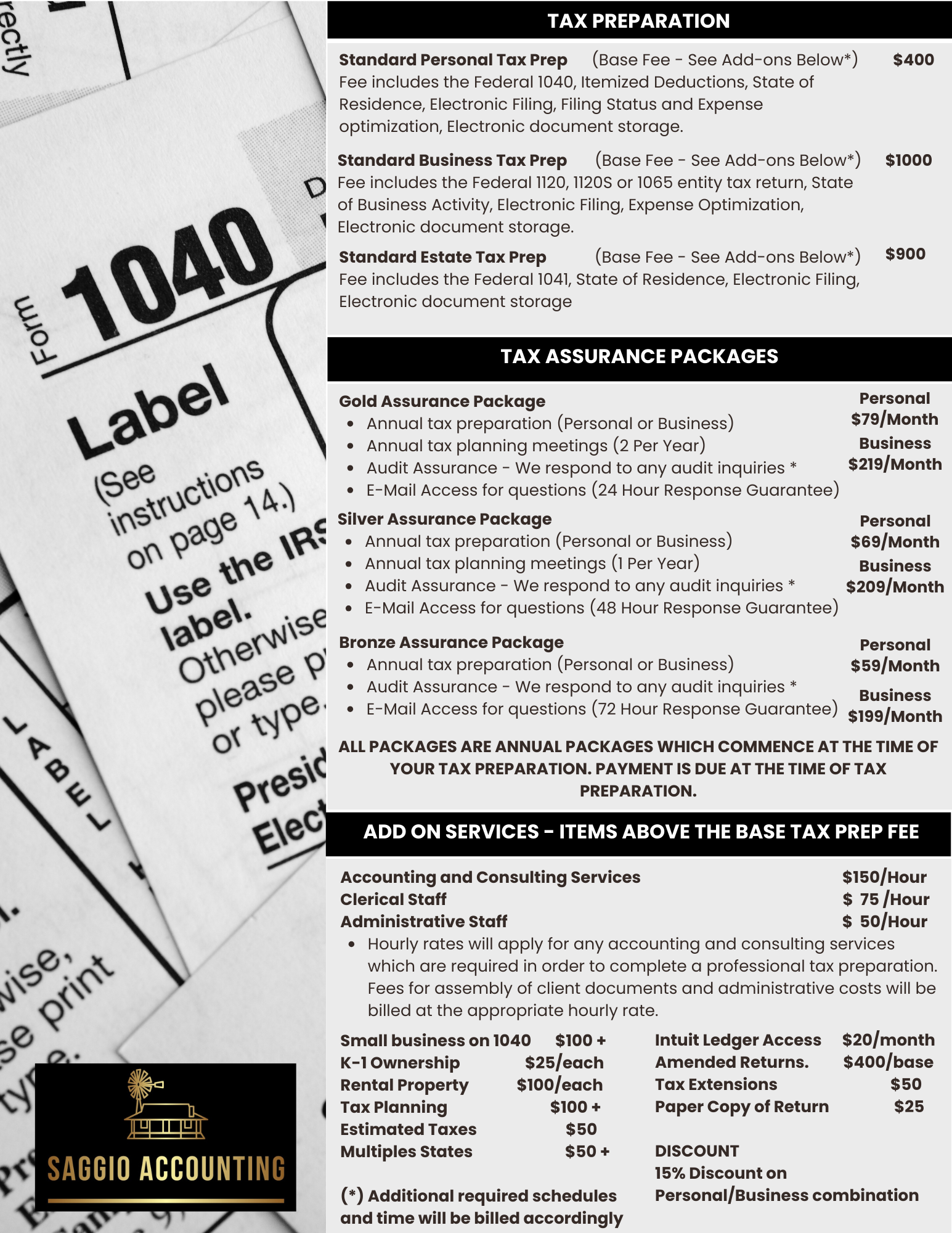

TAX ASSURANCE PRICING

Personal Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages.

Bronze Assurance Package

-

Annual Tax Preparation

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail Access for questions (36 Hour Response)

TAX ASSURANCE PRICING

Business Income Tax Services

In addition to our normal tax preparation service, we also offer the Tax Assurance Packages for those clients who want more than just a tax preparation. These packages are annual packages which provide superior tax preparation, tax planning and access to a tax expert via e-mail. All of these additional services are free of charge to those clients who select on of our Tax Assurance Packages. These packages include both the business and personal tax related preparation services.

Bronze Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (72 Hour Response)

Gold Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

2 Tax Planning Meetings per year

-

Audit Assistance - We respond to audit inquiries

-

E-Mail Access for questions (24 Hour Response)

Silver Assurance Package

-

Annual Tax Preparation (Business and Personal)

-

Annual Tax Planning Meeting

-

Audit Assistance - We respond to audit inquiries and E-Mail access for questions (48 Hour Response)